Innovations Moving Structural Ceramics into the Mainstream

The use of ceramics dates back some 25,000 years, to the oldest human settlements’ use of clay vessels and sculptures. These ceramics, as well as infrastructure components such as bricks, tiles, and clay pipes, are made from mainly raw materials. In contrast, advanced ceramics, which began to emerge following the discovery of the Bayer process for refining bauxite in 1887—have superior mechanical, thermal, and electronic properties compared to traditional ceramics. Like traditional ceramics, advanced ceramics require thermal and mechanical processing before use, but they also need chemical pre-processing to separate the high-quality material from ore or convert it from a precursor.

The Up Side and Down Side

In the 1970s, the automotive and aerospace industries recognized the disruptive advantages high-temperature ceramics gave engines in terms of power and efficiency, plus the elimination of the need to actively cool the engine. Ford Motors, in a joint research project with the U.S. Defense Advanced Research Projects Agency (DARPA), went so far as to put a partially ceramic jet engine in a Torino car body:

“With respect to the question: “Can ceramics work?” the DARPA/Ford program has shown that: “Yes, it can be done.” The real question on which we must now focus is “Can it be done consistently and reliably so that it won’t fail.”

– Army Materials and Mechanics Technical Report 81-14, March, 1981.

The conclusion of that report highlights the key issues with structural ceramics—unlike metals or polymers, ceramics are brittle, which makes it an exceptional challenge to accurately predict when they will fail. In addition, when ceramics do fail, they do so suddenly and catastrophically, rather than gracefully like metals. This is not the only limitation: Structural ceramics have extremely high temperature resistance, which means they must be processed by slow and energy-intensive solid-state methods. In addition, high hardness after densification makes machining ceramics to shape a major challenge. The high processing energy needed to make a structural ceramic part means that costs can be exorbitant, even for materials with low-cost feedstocks. Consequently, structural ceramics have only penetrated the most demanding and least cost-sensitive applications.

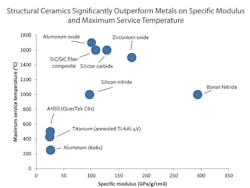

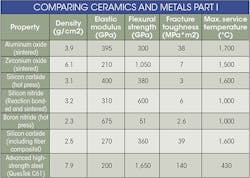

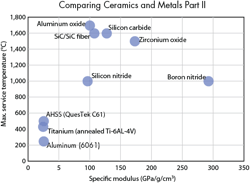

Structural ceramics possess exceptional high-temperature performance, and their specific strengths and moduli give ceramics what it takes to be high-performance structural materials. However, low fracture toughness is a barrier to adoption for all unreinforced ceramics. Structural ceramics behave fundamentally differently than metals and polymers; thus, creating a reference guide on how they perform (or fail to perform) is critical to our understanding of ceramics.

The following table and chart show how structural ceramics stack up against metals.

Ceramic matrix composites (CMCs) seek to solve the persistent brittleness problem. They include any ceramic matrix reinforced with any fiber. In practice, silicon carbide, graphite, and some oxides, such as aluminum oxide, are the most common matrices, along with carbon, silicon, or oxide fibers.

CMCs retain their superior stiffness and temperature stability while significantly improving fracture toughness. Fiber reinforcements in ceramic materials serve two main purposes: controlling crack propagation through the matrix and bearing loads after the material begins to fail. These two mechanisms let CMCs fail gradually, more like the ductile failure of metal, rather than the sudden, catastrophic failures common to unreinforced ceramics.

However, designers who want to make use of us CMCs’ superior mechanical properties will have to pay for the privilege. The lowest cost graphite/carbon fiber CMCs command prices of about $30/lb for simple shapes, which increases dramatically with machining. Silicon carbide matrix/silicon carbide fiber CMCs for high-temperature applications demand high-purity fibers, with prices starting at over $4,000/lb, leading to preform prices of over $9,000/lb.

Expanding CMC Applications

Structural ceramics have found use in a number of industries, but are generally limited to niche-use cases. Current applications are overwhelmingly single functional. For example, some applications use CMC solely for one main attribute such as high hardness for armor and wear components or high temperature resistance for refractory applications. Despite a long development history, ceramics are only beginning to enter structural roles that demand several of their properties.

Commercial aerospace design today is driven by a desire to improve efficiency, and the hot section of jet engines are key areas for innovation. Significant portions of the airflow in jet engines are diverted for cooling the metal components, consuming rather than generating power. Increasing engine operating temperature by employing ceramics rather than metals thus has immediate benefits in improving efficiency and power generation.

Ceramics’ densities are much lower than those of metals, which is a major boon to the extremely weight-sensitive aerospace industry. Weight is especially important on rotating parts, such as turbine blades, as the centripetal forces magnify the benefits of reduced weight many times over. However, the slow, steady progress of advanced metal technologies has played a major role in curtailing the use of structural ceramics in aerospace. While today’s nickel superalloy blades still have lower efficiency and temperature performance than ceramic blades, incremental performance benefits, well understood failure modes, and aerospace companies’ familiarity with these materials have, for the most part, made metals the industry’s material of choice to this day.

Lightweight armor is a must for modern militaries, as excess weight limits maneuverability and degrades a soldier’s ability to perform. Ceramics have been go-to materials for their exceptional hardness and low density, but face challenges from other materials. Metal matrix composites for vehicle armor, such as the aluminum-silicon carbide composites produced by CPS Technologies or MC-21, offer multi-hit capability and toughness in a package of similar density to ceramics. Ceramic plates are currently the only material used for the highest level of personal protection (U.S. National Institute of Justice (NIJ) level IV), though polymer armor made of ultrahigh molecular weight polyethylene (UHMWPE) can stop-caliber rifle rounds (NIJ level III). Although this armor is bulky, it is one third the weight of ceramic plates. New materials, such as Nanocomp’s carbon nanotube (CNT)-reinforced Kevlar and UHMWPE, approach ceramic’s ability to stop high-energy impacts.

Aerospace Takes the Lead

The cutting edge of structural ceramics research is carried out by only a handful of players and they tightly control R&D information, stifling the ability and motivation of outside start-ups to enter the field. Still, innovation bubbles beneath the surface, driven by the need for process disruption.

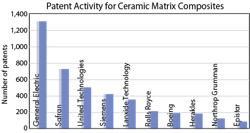

Since 1980, large corporations, led by aerospace companies, have amassed over 8,000 patents in structural ceramics and consolidated capabilities internally through acquisitions and mergers. Although a number of large corporate players are developing structural ceramics, there is comparatively little collaboration between companies. For example, industry leader GE has publicly stated that it will continue to build manufacturing plants for structural ceramics and keep the technology in-house, illustrating the importance it places on end-to-end value chain control.

The figure below shows the top 10 CMC patent assignees in the last 35 years. Eight are large aerospace corporations, with major engine-producers GE Aviation, Pratt and Whitney (through its parent United Technologies Corp.), and Rolls-Royce featured prominently. GE Aviation, with its partner Safran, is the runaway leader on patent count. These two companies own more than a third of total patents since 1980, more than the next eight assignees combined. It should come as no surprise that GE is on track to be the first corporation to bring a CMC part to the hot section of jet engines, with a turbine shroud that will be installed on the 2016 LEAP engine, a high-bypass turbofan.

The few innovative start-ups have technologies that almost exclusively target reductions in the energy needed to make structural ceramics. Some, such as Starfire Systems and Covaron Advanced Materials, have done this by developing novel polymer precursors to structural ceramics that don’t require the repeated pyrolysis and infiltration steps of conventional methods. Others, such as Free Form Fibers and Advanced Ceramic Fibers, have developed processes to create critical fiber forms using less energy.

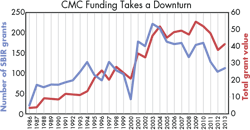

Funding from governments, especially in the form of military Small Business Innovation Research (SBIR) grants in the U.S., are a key source of funding for structural ceramics start-ups. Many, such as Free Form Fibers and Ceralink, have relied on these funding sources during development cycles that typically last five to 10 years. But the number of SBIR grants related to CMCs dropped 50% from 2009 to 2011, and the total value has dropped around 25% in the same timeframe (see the figure below). This undoubtedly further limits new start-ups and makes it difficult for many existing yet pre-revenue players to continue development.

Ceramics’ Future

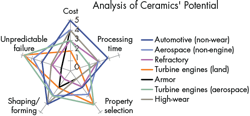

To find roles in new markets, structural ceramics will need to deliver on a broader spectrum of properties than current applications require. In particular, engine applications (aerospace and otherwise) and structural aerospace components all have several properties that earned a rating of four or higher in Lux Research’s analysis. (The rating places 0 at the bottom, least needed, and five at the top, most needed. See the figure below.)

Despite decades of research, structural ceramics have generally struggled to gain commercial traction in these multifunctional applications because of ceramics’ high cost and low toughness. That being said, CMCs’ combination of toughness, strength, and service temperature could let them meet these needs if the engineers can make the requisite innovations. Specifically, technologies that reduce the cost of intermediates like fibers can unlock new markets, and processing advancements can make CMC parts more reliable, thus easing qualification. What’s more, material suppliers’ upstream positions in the value chain means those who commercialize these technologies will not have to penetrate deeply into tightly controlled aerospace, defense, or energy industries to reap significant returns.

The spider plot also shows that reducing structural ceramics’ cost and the incidence of unpredictable brittleness failures will create the most impact. Cost in particular is the most broadly valuable area. Even commercialized applications, such as high-wear parts and armor, are beset by lower cost competitors from other materials. CMCs, which best address the issue of unpredictable failure currently, are by far the most expensive ceramic materials. Despite attempts to lower costs by using alternate precursors or seeking alternate matrix/reinforcement combinations, CMCs have remained stubbornly priced out of most applications. Similarly, attempts to toughen unreinforced ceramics often add cost or reduce a critical property, such as maximum operating temperature. Consequently, production technologies for ceramic fibers (which make up the majority of CMC cost) will have the most disruptive impact.

Traditional structural materials, such as metals, let end users fine-tune desired properties by varying compositions and using combinations of post processing techniques like cold working. In contrast, a specific structural ceramic might often only offer a narrow range of mechanical properties. This creates challenges for end users, who may want one exceptional property from a structural ceramic, such as high-temperature performance in engine applications, but are unwilling to accept the tradeoffs in other properties, such as fracture toughness. If there isn’t a structural ceramic that offers exactly the right combination of properties, these users are often left with no recourse but to use non-ceramic materials. New materials that fill the gaps between available structural ceramics could open many doors, but will require long development and characterization before use.

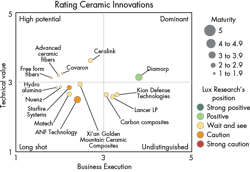

CMCs have the highest potential to displace current structural materials in applications that cannot use current ceramics, and so start-ups developing relevant technologies have high potentials for disruption. Free Form Fibers and Advanced Ceramic Fibers, for example, both claim to have lower-cost methods of turning out continuous ceramic fibers, which addresses the most critical need for structural ceramics. These fibers also slot directly into methods used by industry leaders like GE, increasing their technical potential. However, Free Form Fibers and Advanced Ceramic Fibers are small, pre-revenue, and depend on U.S. SBIR grants to fund them through long developmental cycles. This limits business execution scores and placing them in the High-potential quadrant. (See figure below.)

Many of the key challenges facing structural ceramics stem from the processing methods used to create them. Covaron Advanced Materials, which is developing a novel low-temperature polymer precursor, and Ceralink, which has produced a method for 3D printing silicon carbide, both address challenges in cost, shaping and forming, and processing time. These advances could affect several industries, giving these two companies above-average Technical Value scores. However, both will need significant investment, time, and partners to qualify materials made using these methods before they can commercialize their products, placing these two companies in the High-potential quadrant.

Despite the challenges, opportunity continues to bubble beneath the surface for structural ceramics. Start-ups are quietly developing innovations that can ease current production woes or open the door to entirely new processing methods.

Truly new materials and processes may displace metals and polymers, but the development of ceramics is slow. Compared to more hyped and faster-moving materials innovations, the value of carefully vetting and evaluating potential acquisitions or investments far outweighs any first-mover advantage in the structural ceramics. Targets are much less likely to be acquired or form partnerships elsewhere in the interim. Smart players will rigorously evaluate even the most promising innovators before making a move and reaping the benefits of these materials.

About the Author

Anthony Vicari

Advanced Materials team member

Anthony Vicari is a member of the Advanced Materials team at Lux Research where he covers technological and market developments in emerging materials and manufacturing technologies, including composites, coatings, and metals. He also covers longer-term, potentially disruptive innovations such as metamaterials, smart materials, additive manufacturing, and graphene. Prior to joining Lux Research, Anthony was a R&D Scientist at InnovX Systems, developing improved elemental analysis for handheld x-ray fluorescence spectrometers. Anthony earned an M.S. in Materials Science and Engineering from Carnegie Mellon University, and a B.A. (magna cum laude) in Physics and Chemistry from Harvard University.

Anthony Schiavo

Anthony Schiavo is a Research Associate at Lux Research.