At a Glance:

- One year into COVID-19, the 2021 KPMG CEO Outlook Pulse Survey results show that CEOs demonstrate a measured approach to key issues.

- The report, based on a survey of 500 CEOs in 11 key markets, shows mixed sentiments are fueled by key trends: cybersecurity, regulatory risk, tax risk and supply chain risk.

- Homing in on the 60 manufacturing CEOs, the data shows that 70% of respondents said that in a matter of months the pandemic accelerated the creation of new digital business models and revenue streams.

Business will not return to normal until 2022. That is the overarching prediction from the 2021 KPMG CEO Outlook Pulse Survey.

Add to that knowledge that about 25% of companies believe that their business will never be the same, said Brian Heckler, national industrial manufacturing sector leader, KPMG U.S.

One year after the start of the COVID-19 pandemic, the survey results show that CEOs demonstrate a measured approach to key issues. Since the start of the pandemic, new work conditions, such as work from home arrangements, service delivery and momentum in the vaccine rollout have shored up, and CEOs have more confidence in their company, sector and country over the three-year horizon, relative to last year.

According to Heckler, two themes rank high in people’s minds: “The first is digital business—digital customer engagement, digital ways of collaborating and working within the workforce, and all the knock-on implications of that. The second is reliability—reliability of your workforce to be able to be safe, reliability of your supply chain to be able to deliver what you need when you need it, and the reliability of your systems and processes to be safe for your customer and for your people.”

The survey data showed that the pandemic accelerated the creation of a seamless digital customer experience in a matter of months (noted by 63% of CEOs), while 28% noted that progress sharply accelerated, putting them years in advance of where they expected to be.

This measure of confidence is offset by the fact that confidence in the global economy is at its lowest since 2017. Moreover, these mixed sentiments are fueled by key trends: cybersecurity, regulatory risk, tax risk and supply chain risk, said Heckler.

The Pulse Survey prepared by the audit, tax and advisory firm looks at how the views of influential companies have evolved since July/August 2020. The three-year outlook survey, conducted from Jan. 29-March 4 includes perspectives from 500 CEOs in companies with annual revenue over $500 million) and are located in 11 markets (Australia, Canada, China, France, Germany, India, Italy, Japan, Spain, the UK and the U.S.). The survey covered 11 key industry sectors: asset management, automotive, banking, consumer and retail, energy, infrastructure, insurance, life sciences, manufacturing, technology and telecommunications.

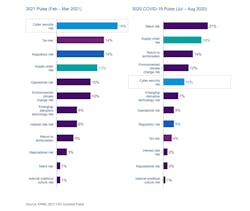

Comparing the 2021 Pulse (February-March 2021) to the 2020 COVID-19 Pulse (July-August 2020), a notable shift was observed in specific risk areas, specifically the bolstering of concerns over cybersecurity.

Heckler noted that CEOs were reluctant to be optimistic in June or July of last year, which explains part of the shift. A significant trend can be observed when comparing the data to what was happening pre-pandemic, when companies were struggling with how they were going to get enough talent, he said. At the time, concerns over digitalization and cyber security were “in the wings,” while trade, regulatory matters and tax matters were low on the agenda.

“Now you see a significant shift to almost doubling the concern around cybersecurity, almost tripling the concern around tax and tax costs, and doubling the concerns around regulatory matters,” pointed out Heckler. “Those portend underlying issues around this shift to digitalization. Working from home and engaging with customers remotely has increased the exposure to potential attack and also being attacked by outsiders, which can be much more damaging to your people and to the business.”

What can decision-makers deduce from this shift? “Leaders that are poising themselves for significant market share gains in the middle of this downturn are those companies that are first accelerating and embracing that new business model around digitalization and customer engagement, and those who are designing to reduce or manage and mitigate this risk around cyber, and having trust and maturity around digital customer engagement,” Heckler said.

Manufacturing Lens

The Pulse Survey included 60 manufacturing CEOs, with the vast majority representing major organizations with revenue of $1 billion or more. According to the findings:

- 86% of manufacturing CEOs want to lock in the sustainability and climate change gains that they have made as a result of the pandemic.

- 90% of manufacturing CEOs are confident or very confident in their company’s growth prospects in the next three years, and 78% are confident or very confident in the sector’s growth prospects in the next three years.

- Supply chain risk was identified as the top risk to their organization’s growth over the next three years, according 30% of manufacturing CEOs.

- A full 70% said that in a matter of months the pandemic accelerated the creation of new digital business models and revenue streams, while another 17% said progress accelerated sharply, putting them years in advance of where they expected to be.

- 63% said that the pandemic accelerated the creation of a seamless digital customer experience in a matter of months, while 28% said that progress sharply accelerated, putting them years in advance of where they expected to be.

Response to the Pandemic

CEOs expressed concerns about access to vaccines and the impact it would have on business. “About 55% of CEOs were very concerned about the ubiquity of the vaccine and the ability for people around the world to get access,” said Heckler. “Therefore, the concern around when is it safe to open. And can you have rolling openings across your workforce in different markets? That is a challenge if you’re running a globally-driven operation. The same is true around supply chain; if you’re sourcing supply from a market that doesn’t have vaccine access, the availability and capacity of that supplier can be different than one that doesn’t have access.”

Respondents also expressed concern about how to monitor those who had or had not been vaccinated. “About 90% said they’re going to ask [employees and networks] whether they have been vaccinated, so they can try to monitor and manage that,” Heckler said. In addition, how companies deal with misinformation and the acceptability of people who want to take the vaccine, is a contentious issue. About a third of executives said they are concerned about attitudes about the safety of the vaccine itself, said Heckler.

Social Component

Data focusing on the U.S. painted a picture of confidence amongst CEOs in the growth prospects of the domestic economy and their businesses. In response to the pandemic, most CEOs reported they will shift their organizations’ focus to the social component of their environmental, social and governance (ESG) programs.

To this end, the following domestic insights were revealed:

- 91% said the U.S. re-entering the Paris Climate Agreement will cause their company to have more stringent ESG practices.

- 96% said the scrutiny of their organization’s diversity performance will continue to increase over the next three years.

- 58% said progress on diversity and inclusion has moved much too slowly in the business world.

- 79% want to lock in the sustainability and climate change gains they have made during the pandemic.