Coronary Stent Market to Hit $8 Billion by 2025

Over $8 billion worth of coronary stents will be sold annually by 2025, according to a new research report by Global Market Insights, Inc. The increase over the years will be created by an increase in artery diseases coupled with a growing demand for minimally invasive surgeries.

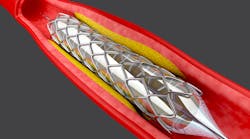

Increasing prevalence and recurrence of cardiovascular disorders across the globe will boost industry growth across the forecast timeframe. Coronary heart disorder is a medical condition where the patient’s blood circulation to the heart is interrupted due to deposition of fatty plaques in the artery walls. It is the most common heart disorder that affects millions of people across the world. Hence, as more people suffer from heart diseases, the more the market for stents will grow.

Increasing technological advancements associated with coronary stents, such as bifurcated stents and use of biodegradable materials, are also expected to prompt a rise in the market value. Bioresorbable stents will grow at 7.8% over the projected period. Bioresorbable stents get absorbed by the body after serving their purpose, thereby lowering the necessity of further surgery for stent removal. Major players operating in the market are also focusing on design innovations to modify the stents as per the patient’s condition. For instance, in February of this year, Medtronic plc announced the launch of Resolute Onyx 2.0 mm Drug-Eluting Stent (DES), the smallest DES on the market. Such technological innovations will boost demand. However, stringent regulations in developed countries, coupled with post-surgical complications, will limit industry growth up to a certain extent.

There are several types of coronary stents; the major ones are drug eluting stents, bare metal stents, and bioresorbable vascular scaffolds. Bare metal stents accounted for $506 million in 2018 and will see significant growth through 2025. Bare-metal stents without a covering or coating were the first stents licensed for use in cardiac arteries. These stents reduce the risk of stent thrombosis after a heart bypass.

End-users are classified as hospitals, cardiac centers, and ambulatory surgical centers. The hospital segment was responsible for around 40% of revenues in 2018 and is poised to show tremendous growth during the forthcoming years. Only hospitals that meet certain strict coronary safety standards can implant stents. Thus, the presence of safety standards and cost efficiency in government hospitals will boost growth in use by hospitals.

The German market is estimated to witness a lucrative growth of 3.0% across the analysis period. An increase in the number of Germans with heart disease will push demand. Also, a rising number of ambulatory surgical centers in European countries is another chief factor propelling business growth.

A few notable companies making stents include Abbott, B. Braun Melsungen AG, Biosensors International Group, Biotronik, Boston Scientific Corp., and Medtronic plc. Industry players are using several strategies to expand their geographic presence and strengthen market position. For instance, this past January, Terumo bought Essen Technology, a China-based company specializing in drug-eluting stents. This will let Terumo expand its market in China and strengthen their Asia Pacific market presence.