Exhausting conventional resources have triggered the global oil and gas industry to shift toward developing unconventional resources such as tight oil and gas, shale oil and gas, and coalbed methane (CBM). Extracting these unconventional resources require specific techniques, which has resulted in increased utilization of hydraulic fracturing.

The growing opportunities concerning hydraulic fracturing are expected to be the major driver for the growth of pressure pumping market over the coming years. In 2016, the pressure pumping industry recorded a revenue of USD $53.1 billion, a figure that is estimated to grow to $75.1 billion by 2025.

With increasing global demand for energy, the conventional sources of oil and gas are witnessing rapid depletion. The global demand for natural gas is expected to ascend at an estimated CAGR of 1.8% from 2012 to 2035, with significant growth in non-OECD countries. This is expected to increase the dependence on conventional sources that are already overexploited.

The development of unconventional gases in the U.S., since 2006, has not only affected the gas supply in North America but also triggered fundamental changes in the global gas market. Shale reserves and tight gas are expected to account for the majority of natural gas production from 2012 to 2020.

1. Pressure Pumping’s Dominance in Hydraulic Fracturing Operations

The strong growth of natural gas production from unconventional sources is expected to have a major impact on the global pressure pumping market. Unconventional oil and gas reservoirs such as shale and CBM are characterized by high porosity and low permeability. The hydrocarbons are stored in the rock matrix and the pores are not well connected for natural flow of formation fluids, which make their extraction difficult by employing conventional stimulation techniques such as perforation and gas lifts. This has boosted the demand for pressure pumping, especially in hydraulic fracturing operations.

Hydraulic fracturing extraction of natural gas from rock formations, such as tight sandstones, coal beds, and shale, requires fractures of about one-half the width of human hair to draw the resource. Hydraulic fracturing allows natural gas to flow by, providing water pressure to create hairline fractures.

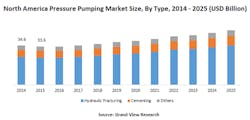

Hydraulic fracturing dominated the global pressure pumping industry in 2016, accounting for 76.7% of the global revenue. North America is likely to dominate the demand for hydraulic fracturing by 2025. Tight oil and gas production in the U.S. is expected to increase to more than 6 million barrels per day from 2017 to 2025, which is likely to drive the demand for pressure pumping.

In terms of market penetration, the hydraulic fracturing segment exhibits the highest market penetration. Shale gas is the largest application segment for hydraulic fracturing. Increasing demand for natural gas, coupled with increasing acreages in shale basins, has been the major factor for the penetration of the hydraulic fracturing segment. Owing to these factors, shale gas is expected to be the most attractive application segment of hydraulic fracturing.

North America pressure pumping market size, by type, 2014-2025 (USD billions) (Source: Grand View Research)

The global pressure pumping market is likely to be dominated by North America in terms of revenue. In the U.S., the upstream oil and gas sector witnessed an upswing of nearly 53% in 2017 as compared to 2016. Such positive investment growth in the upstream oil and gas sector is likely to positively influence the pressure pumping demand in the coming years.

The governments across North America and the Asia-Pacific region have been supporting the use of hydraulic fracturing. However, hydraulic fracturing is banned in some countries such as France and Bulgaria due to the environmental hazards caused by its usage. China has one of the largest shale gas reserves, and the country is undertaking giant steps in the development of these reserves to meet its ever-increasing domestic energy demand. The Chinese government has set challenging targets for itself for shale gas production, which may require the use of hydraulic fracturing. Major oilfield service providers are focusing on investments in China.

2. Environmental Challenges Pertaining to Pressure Pumping

The economic benefits associated with pressure pumping is likely to provide a positive outlook for the market over the coming years. However, it poses certain environmental risks as well as threats to human health and safety. Pressure pumping of oil and gas formations may lead to the contamination of surrounding air and groundwater contamination to the surface. In addition, the corrosion rate in rail tank cars and pipelines increases due to the presence of fracking chemicals present inside the oil obtained through pressure pumping.

Countries such as the UK and South Africa imposed a temporary moratorium on pressure pumping. The countries later lifted the ban on the practice and implemented regulations instead of complete prohibition. Germany has announced flexible regulation that will allow pressure pumping for exploiting shale gas reserves with the exception of wetland areas. The European Union has framed a recommendation for optimum principles for high-volume hydraulic fracturing. The regulatory regimes of the EU require full disclosure of additives. Stringent regulations and strict standards, coupled with regional bans on hydraulic fracturing, are expected to remain the key challenges for market participants in the coming years.

3. Oil and Gas Price Fluctuation Remains a Major Challenge

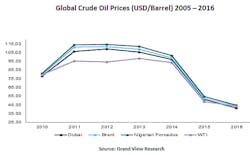

Fluctuations in oil prices remain a key factor that directly impacts the demand for pressure pumping in the oil and gas industry. The World Energy Investment 2017 report published by the International Energy Association (IEA) cited a plunge of nearly 44% in upstream oil and gas investment from 2014 to 2016. This factor, coupled with low oil prices, directly affected the global pressure pumping market during 2014-2016.

Global crude oil prices (USD/barrel) 2005-2016 (Source: Grand View Research)

However, the scenario changed in 2017, as Middle East and Russia reported marginal growth of nearly 4% and 6% respectively in upstream oil and gas investments. Increasing upstream oil and gas investment in Russia was primarily due to its developed local upstream service industry and exchange-effects. The stable investment environment in upstream sector is expected to drive the demand for pressure pumping market.

4. Future Trends and Insights

As per Grand View Research, the market for pressure pumping shall evolve concurrently with the growth of hydraulic fracturing operations around the globe, especially in the North America region. In addition, the emergence of electric pressure pumping is further aiding the industry’s growth in terms of commercial and environmental benefits.

Major industry participants are concentrating on developing various extraction systems to achieve greater yield. Companies are providing customized product offerings to their clients to achieve a major market share. Major industry participants include Schlumberger Limited, Halliburton, Calfrac Energy Services Ltd, Baker Hughes, Superior Energy Services, Inc., Trican, and C&J Energy Services, Inc.

Priyank Bhadoriya is a research analyst in oil, gas, chemicals, machinery, and construction for Grand View Research.