The Powder Metal Industry Outlook: 2019

The powder metallurgy (PM) industry began 2019 facing a subdued business outlook. Red flags warned of caution ahead. But first, let’s begin with a review of 2018, in which most PM sectors posted modest growth.

The traditional press‐and-sinter sector gained last year, and metal injection molding (MIM) companies enjoyed sales increases in the 5% to 10% range. Metal powder producers and PM equipment builders also reported positive gains with equipment companies reporting rising demand for automation packages and robotics. Interest in metal additive manufacturing (AM) continues at a rapid pace. But AM companies are still tackling challenges related to qualifying parts for commercial production runs.

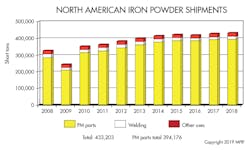

North American Iron Powder Shipments (1 st = 0.907 mt):

The Outlook for 2019

Depending on the market niche, 2019 looks like a flat or modestly down year for powder metals. PM’s heartland, Western Pennsylvania, remains positive, but there is some softening reported through the first quarter. The lawn and garden market is holding up well. So are appliances and construction equipment. Nevertheless, the automotive segment continues to raise concerns.

In September of last year, MPIF performed its annual PM Industry Pulse Survey. Of the responding members of the Powder Metallurgy Parts Association, 62% projected an increase in capital spending for 2019, while 31% reported spending will remain the same as 2018.

Longstanding family-owned PM parts makers are still thriving. Three typical medium size companies in the Midwest and Pennsylvania expect fairly strong gains this year. “Customers can speak to the owner on the phone with no bureaucratic interference,” a CEO of one company reports. “We provide quick decision making,” says another company executive.

Nevertheless, the metal powder market is uncertain. Some observers believe fewer powder shipments reported during the first quarter of 2019 signal a further weakening market or a slowdown in demand. Caution reigns for the remainder of the year.

Equipment builders also forecast a slower year but there is interest in compacting presses in the 350‐ to 550‐ton range. The press market seems to be settling into annual builds of 20 to 25 presses. Automation of presses and robotics in furnace loading continues as a steady trend.

The Automotive Market

The traditional PM industry’s most important market, the auto industry, is driving into a new era with no brakes. Everything is changing: the product mix; consumer demographics; and the move to hybrid vehicles (HVs), electric vehicles (EVs), and self‐driving or autonomous vehicles. Many observers forecast the PM industry’s major market will slowly decline in the next five to 10 years. This offers both challenges and opportunities for everyone.

Uncertainty overhangs the business climate for 2019, depending upon what automotive platforms parts makers are supplying. In addition, total North American vehicle sales are expected to fall below 17 million units. Early estimates range from 16.5 to 16.8 million units.

Traditional passenger car models are out of fashion, especially among Millennials. An article headline in The New York Times has a tongue‐in‐cheek but sobering omen for car makers and their suppliers: “Owning a Car Will Soon Be as Quaint as Owning a Horse.”

Without a doubt, hybrid and electric vehicles are here to stay. Some predict electric vehicles will account for 10% of the automotive market within the next 10 years. Right now, there is no practical refueling infrastructure yet for plug‐ins. But it will happen, and the PM industry must be ready. And there is more sobering news: Norway has launched an ambitious plan to offer only electric cars for sale beginning in 2025. The goal is electric or hydrogen or plug‐in hybrids. Currently 37% of Norway’s automotive market consists of hybrid and electric vehicles.

Electric vehicles offer opportunities for innovative PM designs. For example, soft magnetic composite cores could be used in main drive motors and motors for oil and cooling pumps.

While demand for SUV and light trucks still thrives in North America, the new models contain smaller engines (six and four cylinders) with smaller, more-efficient nine- to 10‐speed transmissions. The result is less weight with fewer connecting rods and main bearing caps, which equates to less powder shipments even though some top‐of‐line fully loaded AWD trucks contain more than 100 lb of PM parts. The average light truck model—such as the Ford F150, Chevrolet Silverado, or Dodge RAM 1500 classes—contains about 75 lb of PM parts. The result of the overall decrease in number of cylinders and other efforts to cut weight activities have reduced the average weight of PM parts in North American passenger vehicles to 43 lb.

Auto engineers are using more modeling and less time‐consuming, physical testing to reduce costs and decrease time to market. Unfortunately, adequate data for modeling powder-metal parts is lacking. Filling this need calls for additional data to be generated and added in the Global PM Property Database.

MIM and AM Trends

The 2019 outlook for metal injection molding (MIM) remains positive and firm. Estimated 2018 sales of MIM parts in the U.S. increased by a range of 5% to 10% ($440 to $460 million). In contrast, estimated sales of MIM parts in China (including Taiwan) exceeded $1 billion. European MIM parts sales track U.S. sales closely or are slightly higher. Total global MIM parts sales are estimated at about $2.6 billion.

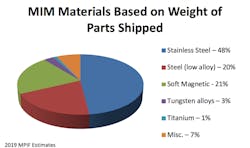

It is also estimated that MIM‐grade fine powders consumed in the U.S. (domestic and imported materials) increased by up to 10% in 2018 to 7,623,000 lb. This includes fine powders for metal additive manufacturing (AM). Based on the MPIF PM Industry Pulse Survey, responding members of the Metal Injection Molding Association (MIMA) (below), report an estimate of materials used by weight of MIM parts shipped:

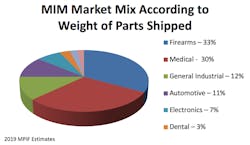

The MIM market mix according to weight of parts shipped (below):

The medical and dental markets will continue growing along with MIM parts in vehicles. The firearms market flattened in 2018 and remains flat this year.

Optimism dominates market expectations for 2019. The MPIF survey reports that 72% of MIMA respondents say sales will increase, while 28% say sales levels will be stable. The most important manufacturing/engineering challenges facing PM firms in 2019 include reducing time‐to‐market, expanding capacity, reducing scrap, and developing new materials. MIM companies are also actively considering potential manufacturing marriages with AM processes.

Metal powder suppliers, domestically and internationally, are expanding R&D programs and production capacities for a variety of metal AM‐grade fine powders. They include cobalt-chrome, titanium, aluminum, stainless steel, low‐alloy steel, tool steel, copper, tungsten and tungsten carbide alloys, the Inconel family of materials, and aluminide alloys such as titanium aluminide and nickel aluminides.

Technology Trends

Technology never sleeps in the PM industry. It’s always reinventing itself with new materials, processes, and products that will lead to innovations in the future. Metal powder makers, equipment builders, and PM process companies are all investing in new technologies to expand the market.

Enhanced lubrication methods have been developed to extend tool life and improve surface finish of PM parts. There is also work on binder‐treated powder blends and low‐segregation additives. New aluminum alloys are available to meet demands for traditional PM, additive manufacturing, and metal injection molding.

Developments in field-assisted sintering show a trend to flash or ultra‐rapid processing emphasizing net‐shaping capabilities. In addition, recent R&D undertaken includes strain‐controlled fatigue, rust prevention, impact testing of gear teeth, and die wall lubrication for warm tooling compaction.