Sales of carbon fiber composites are expected to exceed 290,000 tons in 2024, which should be worth $31 billion, according to recent report from Global Market Insights Inc. Strong demand from aerospace and defense industries based on its light weight and superior strength will drive industry growth in composites through 2024. The aerospace industry should see an additional bump in demand for composites as fuel economy and lightweight airliners will continue to be in Increasing demand.

Composites will also benefit from short processing times and better formability. And extended shelf lives offer bulk buying that further support manufacturers.

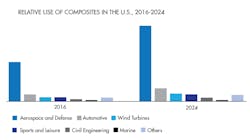

Composites will also be used more widely in end-use industries such as automotive, wind turbines, sports and leisure, construction, and marine. But recycling issues faced by manufacturers, along with supply chain management, may limit the growth of the carbon fiber composites market. Producers will focus on improving their distribution to meet the increasing demand.

Key players such as Boeing and Airbus are using composites for over half of each aircraft (by weight) for their most recent commercial aircrafts. Reducing the price of composites will further increase its penetration in mid-range passenger cars. Higher durability, along with enhanced strength, will help composites replace traditional materials.

In Europe, carbon composites will undergo significant growth during the forecast timeframe owing to strong demand from the automotive sector. Stringent government regulations towards mandatory use of lightweight materials in the vehicles that improves efficiency by reducing fuel consumption will support the growth.

In the Asia/Pacific region, the carbon fiber composites market is anticipated to see its highest growth, 12%, up through 2024. Major manufacturers in the region—particularly in China, Japan, South Korea, and Taiwan—will increase use and revenue generation based on composites. Plus, the automotive and aerospace industries in the region will further drive demand.

SGL, Toray+Zoltek, Toho, Rock West Comp., MRC, and Solvay are among the few major players in the carbon fiber composites market. Other key manufacturers include Hexcel, Aksa, Hyongsung, Zhongu-Shenying, Hengshen Fib. Mat., and Sonstige. Manufacturers are focusing on increasing production to keep pace with the escalation demand. Mergers and acquisitions is the key strategy adopted by the composite manufacturers, and they anticipate this will offer them a competitive edge. For instance, in March 2014, Toray acquired Zoltek to gain a leading position in the market. Moreover, price reduction is another move adopted by producers to penetrate various end-use industry.

For a look at the complete report, click here.