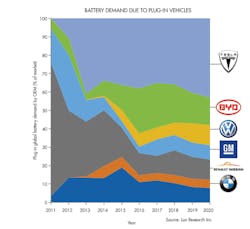

Plug-In Vehicles Will Consume $10 Billion in Batteries by 2020

The market for batteries used in plug-in vehicles will climb to $10 billion in 2020, with electric vehicles (EVs) emerging as the drivetrain of choice, according to a recent report from Lux Research. Just six large carmakers will account for 90% of that battery demand: Tesla, BYD, Volkswagen, General Motors, Renault-Nissan, and BMW. Among battery-makers, Panasonic will keep its lead as the world’s largest battery maker with 46% of market share, followed by BYD, LG Chem, NEC, and then Samsung SDI.

“Plug-in adoption is ultimately being fueled by rapidly decreasing battery costs and the success of early EVs such as Tesla’s Model S and Nissan’s Leaf, which has forced a number of other OEMs to make more serious commitments to developing plug-in vehicles,” says Chris Robinson, Lux Research associate and lead author of the report titled, Segmenting the $10 Billion Battery Market for Plug-in Vehicles: Market Share Projections for OEMs, Individual Models, and Suppliers.

He also predicts that consumers will soon be able to purchase electric vehicles with 200 miles of range for less than $40,000, almost half the price of the long-range EVs available today.

Lux Research forecasted the market for about 90 plug-ins and fuel-cell vehicles (FCVs) and identified implications for the energy-storage industry. Among the findings:

• EVs will take a giant share of battery demand. Plug-in hybrid electric vehicles (PHEVs) will do well in unit sales, accounting for 740,000 of 1.5 million plug-in vehicles. Still, EVs will account for over 80% of the energy storage demand, due to their larger battery packs.

• Tesla’s dominance will grow. The company, driven by its forthcoming Model 3, will continue to power the lion’s share of battery demand from EVs through 2020. Although the company is unlikely to meet its own aggressive sales targets, Tesla will still account for nearly half of the EV market’s battery consumption—followed by Nissan and GM.

• BYD will lose its PHEV lead in 2019. BYD will still dominate battery demand from PHEVs on the strength of robust sales driven by generous subsidies. But the Chinese company will cede its lead in 2019 when European and American carmakers gain ground. Volkswagen will show the most growth as it focuses on plug-ins following its emissions scandal, while Toyota will continue to lag in PHEV sales as it focuses more on hybrids and fuel cells.

Chris Robinson, a research associate at Lux Research, co-authored this column.