Much has been written about the impact of the Internet of Things (IoT) and machine connectivity across the globe. It is estimated that by 2020, there will be more than 34 billion connected machines worldwide. In manufacturing, a similar phenomenon is taking place that will see in excess of 923 million manufacturing IoT devices in place by that same date.

But with the spotlight so tightly focused on gains in efficiency, quality and cost improvement, it’s important not to overlook the obvious partner in this amazing transformation: the role played by original equipment manufacturers (OEMs). As the sheer scale of the manufacturing data increases, OEMs are finding they too must transform their business model and product offerings to keep up and remain competitive.Metal cutting is the fastest growing segment of the machine tool industry.

Impact on OEMs

Manufacturing operations are largely perceived as companies that “make the stuff.” But before the products we use every day are made, OEMs further upstream—and often out of sight of the consumer—are diligently making the machines that make the stuff. The impact of connectivity and data capture on OEMs is just as profound as on producer companies and many are rushing to keep pace. Here are a few of the ways manufacturing data is affecting OEMs as Industry 4.0 takes off:

Closing gaps. With production companies gaining access to precise, real-time, and actionable data, they are more aware of what they need from OEMs in terms of equipment utilization and control. This closes gaps between producers and OEMs. Data can be analyzed to request functionality from OEM equipment makers, and the OEMs can respond confidently with new or revised products.

OEMs are also being forced to include software options they hadn’t considered previously. They are finding the need to increase their reliance upon software and to develop new partners who provide cloud connectivity or analytics and to include that functionality as a native offering within equipment. No OEM wants to be caught off-guard, and the new relationships between these providers means that OEMs will do more than just deliver equipment with improved functionality; that equipment will also be more readily connected to the producers’ connection needs, and with fewer compatibility issues.

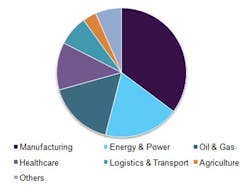

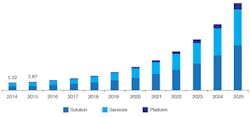

Global IIoT initiatives will unlock approximately $933.62 billion by 2025, according to Grand View Research, with manufacturing expected to be one of the largest adaptors.

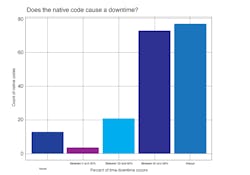

Value perception. As companies ramp up their data requirements for OEM equipment, many OEMs are finding new value-added capabilities that boost value perception among their customers. By embracing IoT technology and building it directly into equipment, overall IoT implementation costs are reduced at the factory level. This allows OEM customers to incorporate IoT capability into an already-actionable connectivity scheme or to add capability down the road with less upgrade time and downtime. Often, this is as simple as downloading the correct applications and drivers, then mapping them into the company’s chosen platform for analytics, management, or decision-making.

This value to end-use customers is also realized through reduced maintenance cost and associated downtime. Most producers have experienced the defeat of waiting on a technician or part to arrive while a machine with critical orders sits busily doing nothing. But as OEMs add IoT capability to their equipment, they can develop a suite of valuable tools to offer their customers. In many cases, technicians are able to perform “virtual service calls” to correct the problem remotely or to direct in-house maintenance to the exact point of trouble. And using real-time data, they are also able to develop predictive maintenance programs for equipment. This allows for the just-in-time (JIT) delivery of parts, reduced tech visits, and an overall reduction of unplanned downtime and other associated costs. One study estimates maintenance savings of as much as 40%. This adds to an OEM’s value perception and makes the OEM a “solutions partner” rather than just a machine builder.

For most OEMs in the manufacturing space, services empowered by IIoT will be the largest driver of revenue growth over the next decade. Analytics platforms like MachineMetrics leverage IIoT connectivity to enable OEMs to resolve machine problems through remote diagnosis and reduce on-site service visits by 10 to 20%, optimize preventative maintenance plans, validate warranty claims, and receive predictive maintenance alerts to understand new service opportunities post-warranty period.

Development of New Revenue Streams

Another way manufacturing data is affecting OEMs is through the creation of new revenue streams. IoT technology allows OEMs to create new service and product offerings not available before. And real-time data and analytics can allow an OEM to craft industry-specific solutions on a customer-by-customer basis and offer them as a service. As an example, one producer may use a piece of equipment for delicate or light duty production while another uses the equipment for more abrasive or heavy-duty goods. Each producer places different workload requirements on the same type of machine.

With OEM access to manufacturing data, the OEM can craft custom maintenance programs based on real-time analysis. Lighter-used equipment may be able to extend maintenance and service periods longer while heavier-duty use would see better staging of consumables and parts on a JIT basis for shorter maintenance cycles and reduced breakdowns from the harsher running conditions. Both producers would reap savings in associated costs, with the OEM able to accurately predict and offer the right blend of care to optimize the machine.

IIoT platforms like MachineMetrics empowers OEMs to trigger notifications to their customers when the system identifies a “severe alarm” through alarm analytics to warn shop floor workers of pending problems and even predict/prevent maintenance events to reduce unplanned and costly outages.

Revenue for overall parts and service is enhanced by IoT as well. A recent study by McKinsey indicates that the margins on aftermarket parts and services for OEMs is close to 25%, compared to an average of 10% on new equipment. IoT technology is allowing OEMs to take advantage of this market segment rather than ceding the parts and service market to other suppliers. Visibility provided by IoT connectivity that allows OEMs to see all the way to the factory floor is invaluable in identifying trends to capture further parts sales and to develop new services at higher margins.

As companies continue to add devices, pressure is on OEMs to improve product offerings, respond quicker to design change and new iterations, and solutions rather than just equipment. Those OEMs that ignore the data will fall behind. But those that aggressively embrace IoT technology will find themselves a part of an entirely new “ecosystem” that will not only serve their end use customer better but will also help them remain competitive.

Graham Immerman is director of marketing for MachineMetrics.