The highest number of orders for robots ever recorded happened in the first nine months of 2017. 27,294 orders of robots valued at approximately $1.473 billion were sold in North America. These figures represent growth of 14% in units and 10% in dollars compared to the first nine months of 2016. Automotive-related orders are up 11% in units and 10% in dollars, while non-automotive orders are up 20% and 11%, respectively. The hottest industries were metals (54%), automotive components (42%), and food and consumer goods (21%). This article will break down the record-breaking news, and what that means for manufacturers.

Epson released the T3 in 2017. The new low-cost robotic arm frees workers from repetitive loading and unloading applications, and more. This model has a built-in controller, along with a battery-less motor unit that reduces maintenance and downtime.

Motion Control and Motors

- Total motion control shipments increased by 10% to $2.6 billion

- Motors represented 38% of shipments

- Actuators and mechanical systems comprised 18% of shipments

- Electronic drives followed closely, with 17% of shipments

The fastest-growing categories in the first nine months of 2017 were:

- Motion controllers at 24%, to $147 million

- Sensors and feedback devices at 20%, to $116 million

- AC drives at 15%, to $295 million

- Actuators and mechanical systems at 13%, to $479 million

- Motors at 11%, to $1 billion.

Denso’s latest HSR four-axis SCARA robot uses advanced vibration control, a newly designed highly rigid lightweight arm, and improved heat dissipation in the base unit to achieve new levels of continuous high-speed performance and repeatability.

Vision and Imaging

The North American machine vision market continued its best start to a year ever in 2017, with growth of 14% overall to $1.937 billion, 14% in systems to $1.657 billion, and 14% in components to $271 million. Each of those three categories set new records in the first nine months of this year, and every individual product category experienced positive year-over-year growth for the same period last year. Some notable growth rates were:

- Smart cameras (21% to $295 million)

- Lighting (20% to $54 million)

- Software (16% to $15 million)

- Component cameras (14% to $143 million)

Experts believe lighting, optics, imaging boards, and software will trend up, while camera sales will remain flat over the next six months. Additionally, expectations are for Application Specific Machine Vision (ASMV) systems to increase and smart cameras to remain flat over the same period. The U.S. manufacturing sector expanded in the second quarter (avg. PMI of 53.0) and is expected to remain strong through the end of the year.

The Advantage 100 smart camera offers OEMs the ability to leverage the power of Cognex vision and ID tools in an embedded product that is compact (23 mm × 44 mm × 54 mm) and flexible, but also cost-effective.

What it All Means

Each age in the Industrial Revolution has brought with it a wave of new opportunities and benefits. From steam to electricity to computers—and now automation. Society is transformed by technological advances that increase productivity and prosperity, and broaden the availability of innovative goods and services. But more than anything, society is transformed by new, rewarding jobs that improve workers’ health and safety, and which allow them to apply their innate creativity and problem-solving skills. The following will expand on what all of this growth means going forward.

More Robots, More Jobs

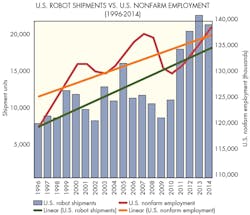

As employers add automation technologies such as robots, job titles and tasks are changing. Nevertheless, the number of jobs continues to rise. New technologies allow companies to become more productive and create higher-quality products in a safer environment for their employees. This allows them to be more competitive in the global marketplace and grow their businesses.

We see this in the statistics: Over the seven-year period from 2010 to 2016, 136,748 robots were shipped to US customers—the most in any seven-year period ever recorded by the U.S. robotics industry. In that same period, manufacturing employment increased by 894,000, and the U.S. unemployment rate decreased from 9.8% in 2010 to 4.7% in 2016.

Take a look at two specific companies of note: Amazon had more than 45,000 employees when it introduced robots in 2014. While the company continues to add robots to its operations, it has grown to over 90,000 employees, with a drive to hire more than 100,000 new people by the end of 2018.

Similarly, General Motors grew from 80,000 U.S. employees in 2012 to 105,000 in 2016, all the while increasing the number of new U.S. robot applications by about 10,000. We see similar results from employers ranging from multinational companies with thousands of employees to small manufacturing firms.

The Skills Gap and its Impact

Skilled workers are key to companies’ success and countries’ economic development. Employers rank the availability of highly skilled workers who facilitate a shift toward innovation and advanced manufacturing as the most critical driver of global competitiveness. But studies show an increasing skills gap, with as many as two million jobs going unfilled in the manufacturing industry alone in the next decade. Fully 80% of manufacturers report a shortage of qualified applicants for skilled production positions, and the shortage could cost U.S. manufacturers 11% of their annual earnings.

Changing Job Titles Reflect Changing Tasks

In the automation age, as in the computer age before it, job titles shift to reflect the impact of technology. A recent study concluded that occupations that have 10% more new job titles grow 5% faster. Just as we saw the rise of entire industries around previously unheard-of job titles in cloud services, mobile apps, social media, and more, we’re seeing similar shifts in the automation age. As lower-level tasks are automated with advanced technologies such as robots, new job titles and industries arise across nearly every economic sector.

Supply and Demand and Wages

In the manufacturing industry, which is the largest user of automation today, the skills gap is driving up what are already strong wages and benefits—well over the U.S. average. In 2015, manufacturing workers earned $81,289 including pay and benefits, compared to $63,830 for the average worker in all nonfarm industries. And 92% of manufacturing workers were eligible for health insurance benefits. Despite that, manufacturing executives reported an average of 94 days spent recruiting engineering and research employees and 70 days recruiting skilled production workers.

Bridging the Skills Gap

Automation-age jobs range from well-paying, entry-level, and blue-collar positions through engineers and scientists. Stable automation-age manufacturing jobs can start at $20 per hour with just a high school diploma, a few months of automation training, and professional certification. Employers, vocational schools, and universities are offering innovative training approaches that give workers alternatives to the traditional (and expensive) high-school-to-college-to-job route. And employers such as GM are revitalizing apprenticeships, recognizing the significant advantage those programs offer.

As automation grows there will be a continuous shift. While some are worried, the numbers are in favor of humans, and making our society and jobs market better.